Infosys shares fall 2% after subdued revenue guidance; 15% analysts have a ‘sell’ rating

Summary

A weak revenue guidance despite record deal wins is owing to longer tenured deals and weak discretionary spend environment, analysts say.

Shares of technology bellwether Infosys Ltd. fell up to 2% on Friday, April 19, after the company missed revenue estimates and offered softer guidance for the financial year 2025. The US-listed shares of Infosys recovered to trade 1% down at open after falling 8% in pre-market trading on Thursday.

Infosys announced a muted constant currency (CC) revenue growth forecast of 1-3% for FY25 against analyst estimates of 2-6% in CC terms with operating margin guidance at 20-22%.

The Bengaluru-based company slashed its revenue guidance despite winning deal value of $4.5 billion in the quarter, with 44% of it being net new ones. FY24 deal value was the highest ever at $17.7 billion, which the management said will help them in the new financial year.

Weak revenue guidance despite record deal wins is owing to longer tenured deals and a weak discretionary spend environment, said Investec in its note with a ‘Hold’ call. The brokerage has cut its target price to ₹1,540 from ₹1,640 per share.

Investec said it is difficult to predict a recovery in discretionary spends, but based on history, it is usually sudden.

Infosys will be a big beneficiary when discretionary spends return, it noted.

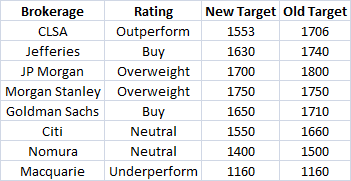

Global brokerage Jefferies has maintained a ‘buy’ rating on the Infosys stock with a price target of ₹1,630. The brokerage said that a decline in CC revenue was due to an impact of contract renegotiation and reduction in scope even though net new deal wins were healthy.

The broking firm said that the FY25 CC revenue growth guidance of 1-3% year-on-year is weak, and it has slashed estimates by 7-8% to factor in the miss.

Citi wrote in its note that the fourth quarter results and guidance were impacted by one-time contract rescoping. It said that ex of one-off, the company’s numbers would broadly have been in line.

The brokerage lowered its Earnings per Share (EPS) estimates for FY25 and FY26 by 3% but added that it would buy dips at ₹1,350 levels, considering all things remain the same.

Citi is ‘neutral’ on Infosys with a price target of ₹1,550 per share.

Nomura in its note said that it sees no signs of discretionary demand revival. It expects the first half of FY25 to be strong for the company as usual seasonality to play out in FY25.

Also, the brokerage said that project Maximus’ impact on margin is expected to play out in the medium term. Nomura has lowered its FY25-26 EPS by 2-3%

Of the 46 analysts that track Infosys, 32 continue to have a ‘buy’ recommendation on the stock, 7 have ‘hold’, while another seven have a ‘sell’ rating.

Infosys shares fell 14% over the last three months and the gauge for IT stocks has emerged as one of the worst performers since the sector is seeking to emerge from a slowdown triggered by higher interest rates and inflation.

The Nifty IT index has also lost nearly 10% of its value in the last three months, compared to a 2% gain clocked by the benchmark Nifty50 during the same period.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter