Brokerages slash HDFC Life’s target price to as low as ₹680 amid margin concerns, shares fall over 4%

Summary

HDFC Life Insurance reported a 14.8% rise in net profit to ₹411 crore for the fourth quarter of FY24. In the same period last year, the company had recorded a net profit of ₹358 crore.

Brokerage firms have reduced their target price for HDFC Life Insurance a day after the insurance firm reported a 14.8% rise in net profit to ₹411 crore for the fourth quarter of FY24.

Despite this growth, concerns over the company’s Value of New Business (VNB) margin, which experienced a decline of more than 300 basis points year-on-year to 26.1%, prompted analysts to revise their outlook.

In response to the development, the shares of the insurer dropped by over 4%.

Here are the revised target prices given by the brokerages:

| Brokerage | Previous target price (₹) | Revised target price (₹) |

|---|---|---|

| HSBC | ₹800 | ₹750 |

| Jefferies | ₹800 | ₹750 |

| Nomura | ₹740 | ₹680 |

| Morgan Stanley | ₹780 | ₹745 |

HSBC maintained a ‘buy’ call but has reduced the target price to ₹750 from ₹800.

The brokerage noted that the Q4 VNB margin was weaker than expected, citing factors such as changes in product mix and rising competitive pressure.

Management’s focus on annual premium equivalent (APE) growth over margins in FY25 was highlighted, along with plans to grow VNB in the mid-teens.

HSBC has cut its FY25-27 VNB margin estimates by 110/70/70 bps, reflecting concerns over future profitability.

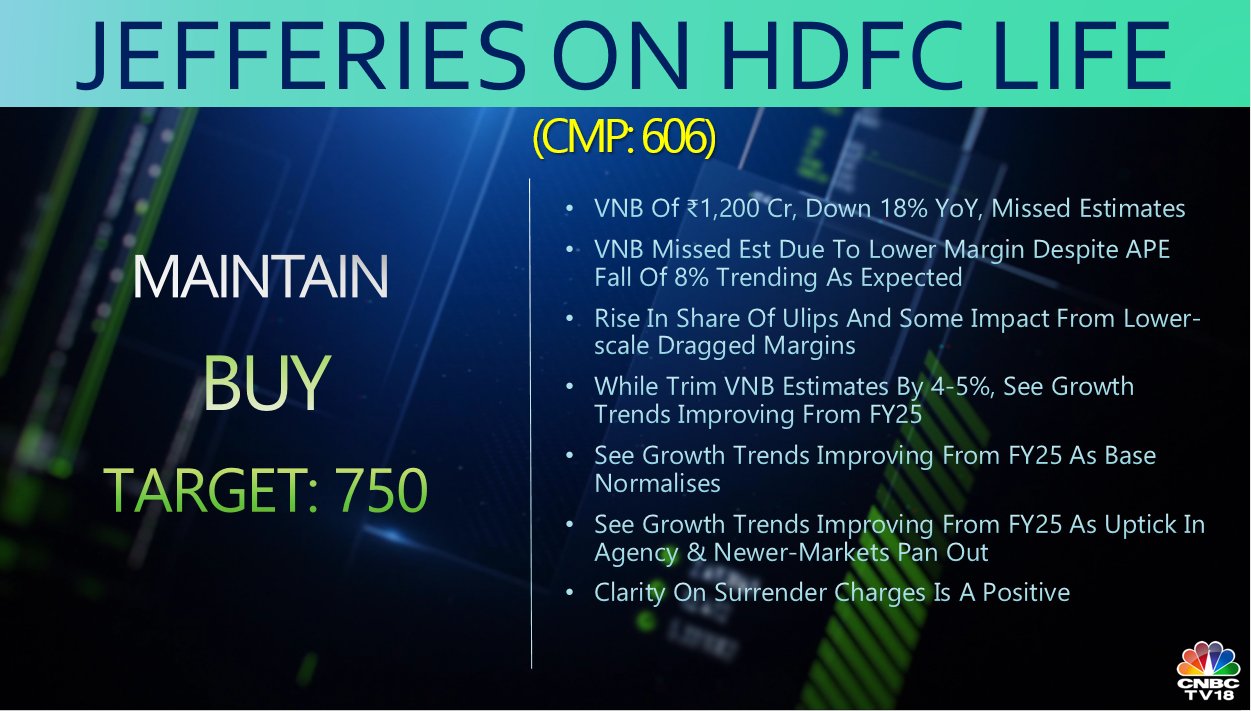

Jefferies also maintained a ‘buy’ call but has adjusted the target price to ₹750 from ₹800.

The brokerage highlighted that HDFC Life’s VNB of ₹1,200 crore, down 18% YoY, missed estimates due to lower margins despite an 8% fall in APE, which was trending as expected.

Jefferies expects growth trends to improve from FY25 as the base normalises and sees an uptick in agency and newer markets.

Clarity on surrender charges was viewed as a positive development.

Nomura, while maintaining a ‘buy’ call, lowered the target price to ₹680 from ₹740.

The brokerage noted that Q4 saw in-line growth but a slightly weak margin.

Concerns were raised regarding the intensified growth vs. margin tradeoff.

However, management’s guidance for FY25, aiming for APE growth to be at least in line with private peers’ at 12-15%, was viewed positively.

Morgan Stanley retained an ‘overweight’ call but reduced the target price to ₹745 from ₹780.

The brokerage highlighted that the Q4 VNB margin missed forecasts largely due to product mix issues.

While guidance for FY25 was healthy, it was relatively conservative compared to past years.

Morgan Stanley expects the stock’s performance in the near term to remain muted given the backdrop of guidance adjustments.

On the other hand, Macquarie takes a neutral stance on HDFC Life with a target price of ₹635.

The brokerage warns investors to brace themselves for a lower Value of New Business (VNB) trajectory, anticipating continued pressure on VNB growth.

HDFC Life’s guidance for private sector industry APE growth of 12%-15% in FY25F aligns with Macquarie’s expectations.

However, the irrational competitive intensity in the protection business is expected to impact margins.

Macquarie estimates VNBV growth to be constrained at ~15% compared to their estimated 18% CAGR (FY24E-26E), with downside risks to their growth estimates.

Despite HDFC Life trading at fair multiples, Macquarie believes that management’s expectations of 15% levels pose a downside risk to their numbers.

At the time of writing this report, the shares of HDFC Life were trading 2.41% lower ₹591.10 apiece on BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter