Earnings preview: Street expects Indian Oil Corp revenue to grow in Q4 but net profit may fall

Summary

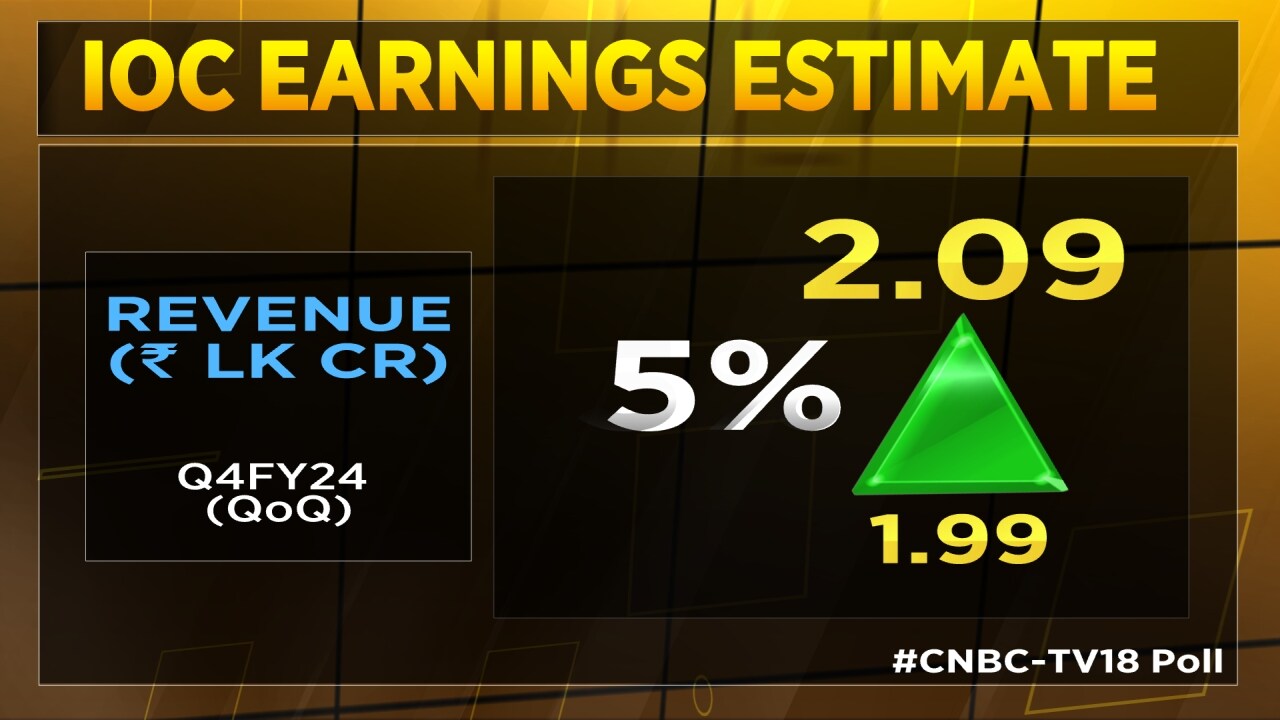

According to a poll conducted by CNBC-TV18, analysts anticipate a 5% increase in revenues on a sequential basis, reaching Rs 2.09 lakh crore. Despite the projected revenue growth, there are expectations of a 5% decline in EBITDA. However, market analysts foresee the marketing segment to sustain its performance, supported by favourable diesel margins.

Indian Oil Corporation Ltd (IOC), the largest oil refiner in India, is set to report its financial results for the quarter ended March 2024 (Q4FY24) on Tuesday, April 30.

According to a poll conducted by CNBC-TV18, analysts anticipate a 5% increase in revenues on a sequential basis, reaching ₹2.09 lakh crore.

Despite the projected revenue growth, there are expectations of a 5% decline in earnings before interest, taxes, depreciation, and amortization (EBITDA) to ₹14,700 crore, compared to ₹15,488 crore reported in the previous quarter. Additionally, the margin is also forecasted to decrease by 70 basis points to 7.1%.

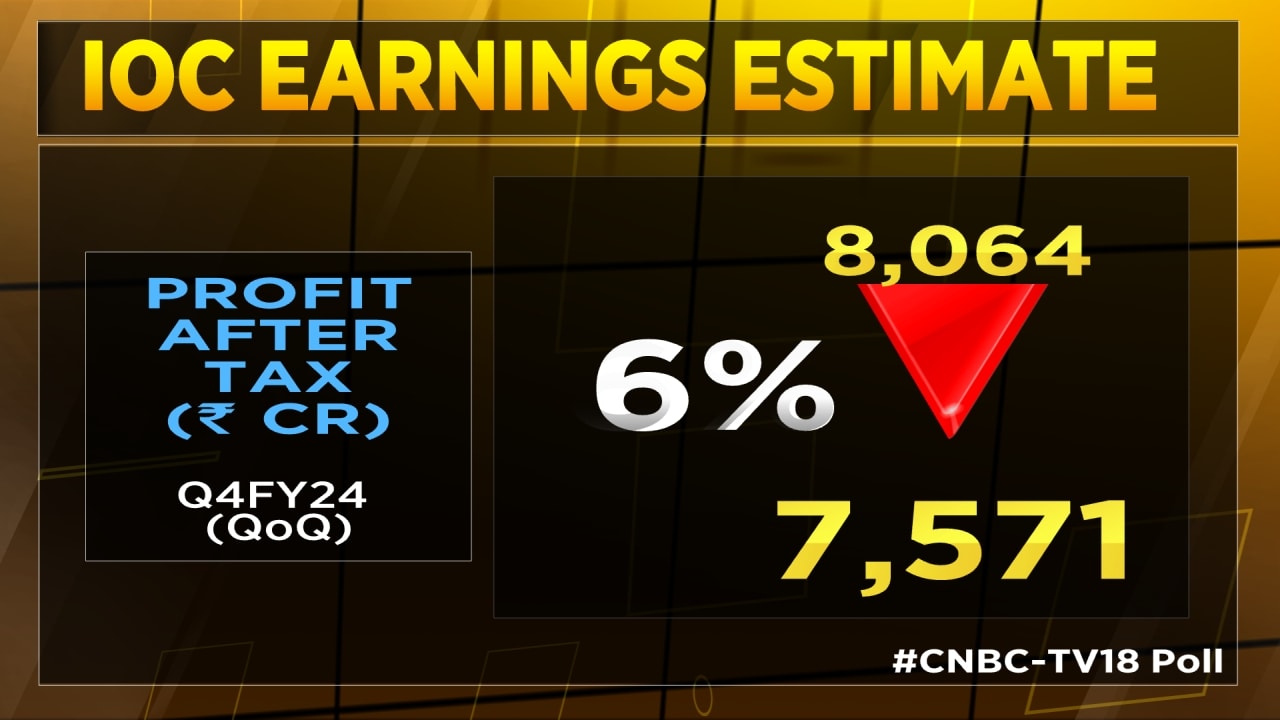

The CNBC-TV18 poll estimates a 6% decline in the quarter’s profit after tax (PAT) to ₹7,571 crore, down from ₹8,064 crore in Q3FY24.

Market analysts foresee the marketing segment sustaining its performance, supported by favourable diesel margins. However, IOC’s refinery throughput is expected to dip by 9% year-on-year. On a sequential basis, it is expected to rise by 6%.

Brokerage firm Motilal Oswal expects IOC’s gross refining margins (GRMs) to stand at $15 per barrel, with gross marketing margins at ₹3.8 per liter, primarily driven by diesel margin. Nevertheless, sequential declines in petrochemical crack spreads might impact the company’s petrochemical division.

Contrastingly, Hindustan Petroleum Corporation Ltd. (HPCL) is anticipated to exhibit strong performance in both refining and marketing segments. Thus, a divided opinion is expected regarding the performance of oil marketing companies in the Q4FY24 earnings season.

In Monday’s trading session, IOC’s stock witnessed a 2.89% surge, closing at ₹176.50. The New Delhi-based company currently commands a market capitalisation of ₹2,49,592.89 crore and has delivered returns of approximately 100% over the past six months.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter