HUL Q4 Results Preview: Price cuts may aid volumes, royalty payout to have an impact

Summary

HUL’s volume growth has ranged between 2% and 3% throughout financial year 2024.

FMCG major Hindustan Unilever Ltd. (HUL) will report its March quarter results on Wednesday amidst the stock having corrected 20% from its 52-week high.

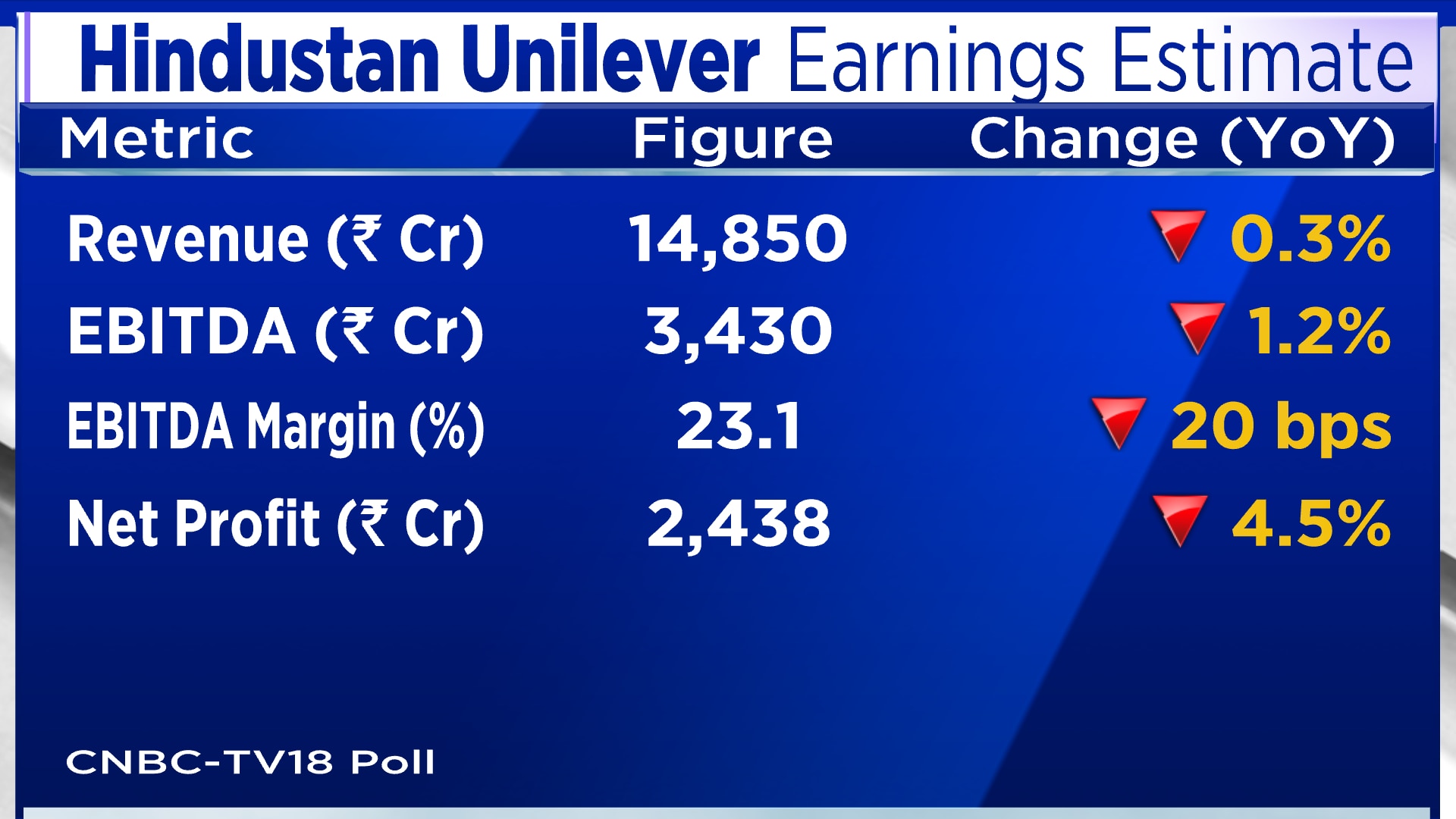

The results will be declared amidst no material pick-up in demand and rural growth still underperforming urban. A CNBC-TV18 poll expects the company’s revenue to remain flat, while profits may decline compared to the same quarter last year.

While the company’s gross margin may improve by 150 basis points to 200 basis points, higher advertising spends, royalty payout to parent Unilever Plc., and expiration of the GSK deal will impact the company’s Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA).

With input prices cooling off, the company undertook price cuts to the tune of 2% and that may lead to a volume growth between 2% and 3% for the quarter compared to last year. HUL’s volume growth has ranged between 2% and 3% throughout financial year 2024.

| HUL’s Volume Growth Trend | |

| Quarter | Growth |

| Q3 FY23 | 5% |

| Q4 FY23 | 4% |

| Q1 FY24 | 3% |

| Q2 FY24 | 2% |

| Q3 FY24 | 2% |

| Q4 FY24 (Est.) | 2-3% |

HUL will have to account for royalty payment of 70 basis points this quarter compared to a 45 basis points increase for the two months of the same quarter last year. Advertising spends are also likely to see a jump to 11% of net sales from 8.7% of sales in the March quarter.

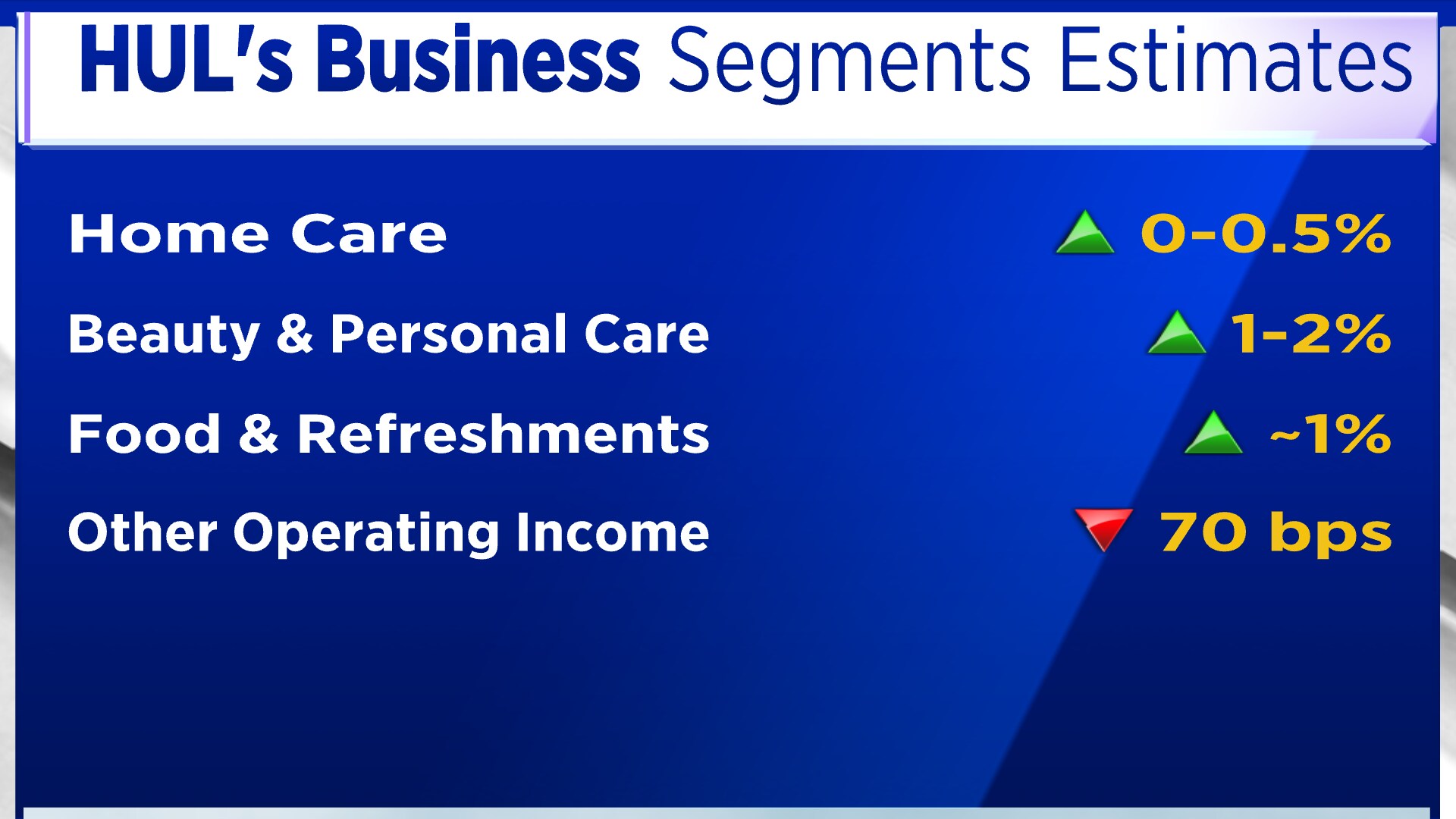

Among business segments, the Home Care business is likely to remain flat, as will the beauty and personal care segment. HUL’s other operating income this quarter may decline 70% due to the discontinuation of the Over-The-Counter (OTC) deal with GSK.

The management of HUL, post the company’s December quarter results had spoken about a challenging operating environment and added that rural income growth and the winter crop yields are the key factors that will determine a recovery.

HUL’s commentary on the demand scenario will be a key monitorable to watch, followed by its outlook on the Ice-Cream business. CNBC-TV18 had exclusively reported on March 20 that the company is evaluating various options for its Ice Cream business.

Shares of HUL are down 15% so far in 2024.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter