Yen drops to a fresh 34-year low as Bank of Japan keeps key rate unchanged

Summary

The Japanese currency is the worst-performer among the Group-of-10 major currencies this year.

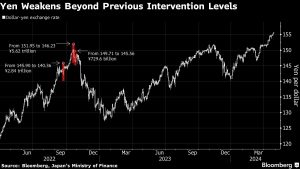

The yen’s relentless decline continued in the wake of the Bank of Japan keeping its key interest rate unchanged, with the currency touching a fresh 34-year low versus the dollar.

It weakened 0.3% to 156.18 as of 1:39 p.m. in Tokyo. The extended slump has heightened speculation that authorities may intervene in the market as soon as today, with further risks to come later when data on the Federal Reserve’s preferred inflation gauge is released.

Investors are on high alert for any rapid snap-back in the yen. They are also wary that Japan may not confirm any intervention, and that some past cases of extreme rebounds have been attributed to algorithmic trading.

The Topix share index rose as much as 1.1% after the BOJ decision, with real estate companies extending gains. The yield on the benchmark 10-year bond slipped to 0.91% from 0.93% earlier in the day.

Meanwhile, the yen is the worst-performer among the Group-of-10 major currencies this year, having already slid 9%. Policymakers have repeatedly warned that depreciation won’t be tolerated if it goes too far too fast. Finance Minister Shunichi Suzuki reiterated after the BOJ meeting that the government will respond appropriately to foreign exchange moves.

“And yet again, BOJ has proved that it can surprise dovish to even the most dovish expectation on the Street,” said Charu Chanana, a strategist at Saxo Capital Markets. US personal consumption data later in the day will be on the radar, “and we are back to waiting for an intervention to stop the rout in the yen. But any intervention, if not coordinated and without the support of a hawkish policy messaging, will still be futile,” she said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter