Bajaj Auto expects to grow faster than the industry as it nears entering Europe

Summary

Bajaj Auto’s Executive Director, Rakesh Sharma, stated to CNBC-TV18 a day after the company disclosed its earnings for the March quarter that they would indeed be striving for double-digit growth.

Pune-based Bajaj Auto on Friday, April 19, said that if the industry grows at 7-8%, they expect their growth to be even higher, possibly in double digits, based on their past performance.

“We would certainly be driving for double-digit growth,” Bajaj Auto’s ED Rakesh Sharma told CNBC-TV18 a day after they reported the company’s earnings for the March quarter.

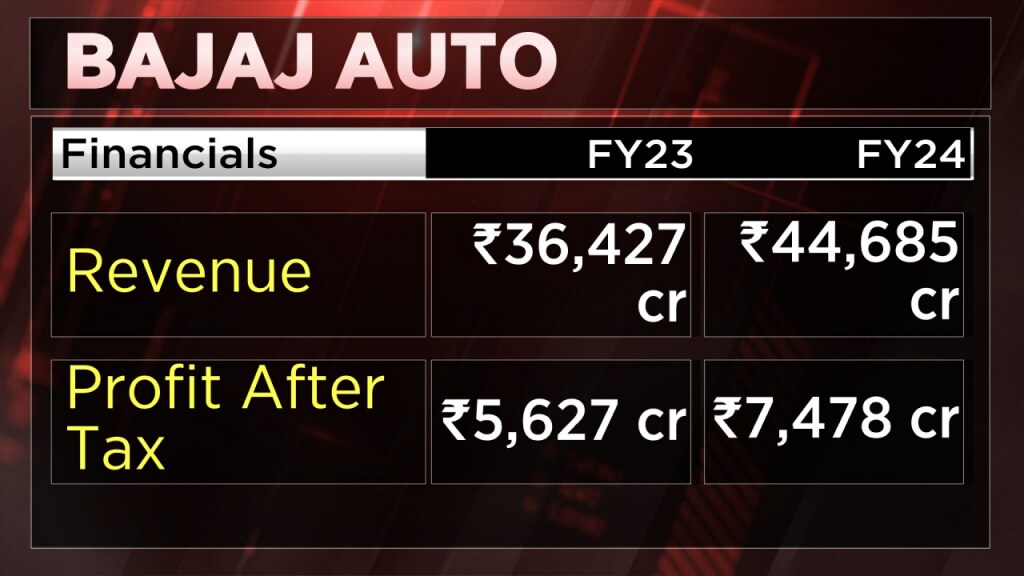

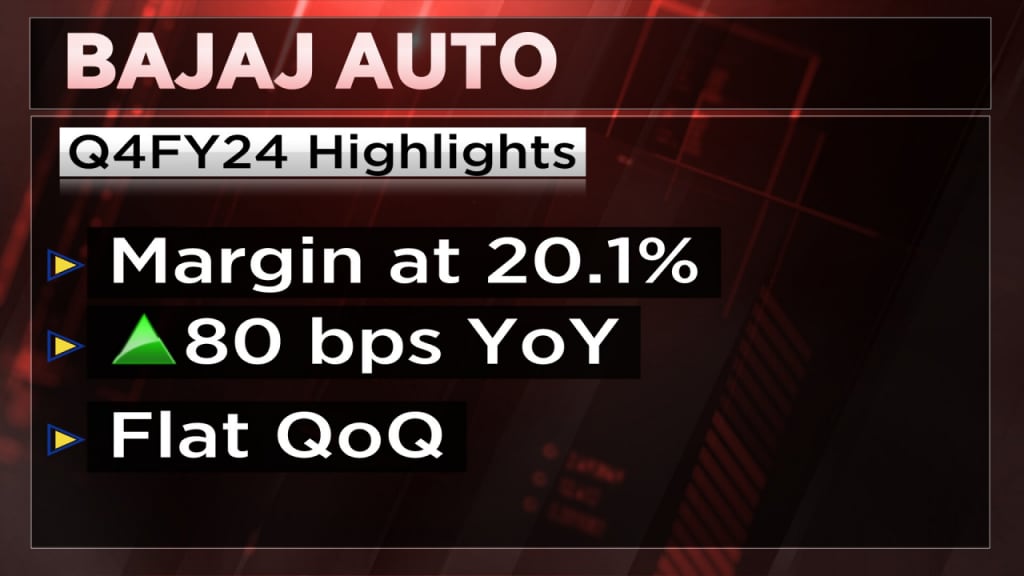

The company declared its Q4FY24 results wherein standalone net profit jumped 35.1% on a year-on-year (YoY) basis to ₹1,936 crore in the January-March quarter. A CNBC-TV18 poll had expected the quarterly profit to come at ₹1,870 crore. The performance came on the back of higher volumes, an increased share of high-margin products, price hikes and lower input costs. The company also declared a dividend of 800% per share for its shareholders.

Also Read | Bajaj Auto Q4 results: Net profit jumps 35% to ₹1,936 crore; auto major declares dividend of ₹80 per share

On their entry into the European market, Sharma mentioned that they will also be focusing on some other new markets, although these won’t have a major impact right away. One of these markets is Brazil, where their new plant will start operating in May. The move is expected to meet the demand that has been waiting and help them extend their reach. Additionally, they are also entering the Venezuelan market and making their debut in Europe.

“So, hopefully by the second half, or let’s say at least the last quarter of the financial year will start to show some impact,” he said.

Bajaj Auto’s better-than-estimated results for the quarter have compelled at least three global analysts to raise their target prices on the auto major’s stock.

Jefferies has raised its target price on Bajaj Auto shares to ₹10,500 with a ‘buy’ call. The brokerage expects a 16% upside from the closing price of the stock on April 18. It has also raised its FY25–26 earnings per share (EPS) estimate by 4%.

Also Read | Bajaj Auto strong Q4 show gets the company three target price hikes — Should you buy?

CLSA, too, raised its target price on the stock to ₹6,889 but retained its ‘sell’ rating. The target price still implies a 23% downside from Thursday’s closing price. It believes the stock is overvalued following the recent rally.

Global brokerage Citi has a ‘sell’ call on the stock but has raised the target price to ₹6,500. It noted that the management’s commentary was positive on domestic two-wheelers demand whereas exports recovery is likely to be more gradual.

The market capitalisation of Bajaj Auto is around Rs 2,43,407.06 crore. Its shares have gained close to 104% in the past year.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter