Bottomline | The risk of rising debt for USD and beyond

Summary

The dollar isn’t going out of fashion anytime soon, but that doesn’t mean rising US debt won’t hurt.

When Elon Musk says anything, people take notice. And when he says that the dollar will be worth nothing if the US doesn’t do anything about its rising debt, the uninitiated are clearly spooked.

To be fair, maybe his expression is possibly a way of calling attention to a matter that requires urgent attention. And it does.

US DEBT WORRIES

But what Musk is saying now, is something others have been saying for a while.

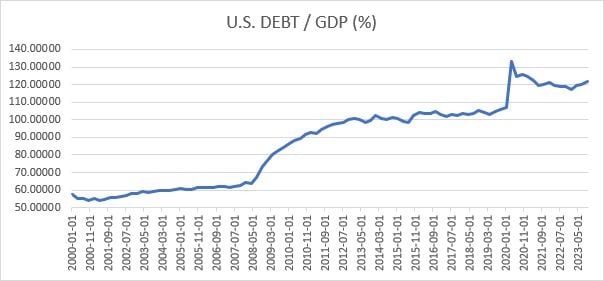

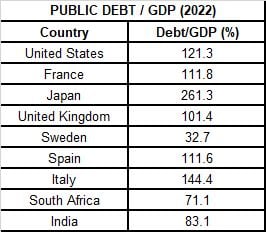

An institution no less than the International Monetary Fund (IMF) at its April briefing said: “Moderate fiscal tightening is expected to resume this year, but significant uncertainty remains. In 2024, a record number of countries, with more than half of the world’s population, are holding elections. Evidence shows that in election years, realised deficits are 0.4 percentage points of GDP higher than budgeted. Looking ahead, global public debt is projected to approach 100% of GDP by the end of the decade. This rise in global public debt is primarily driven by China and the United States, where public debt is now higher and is expected to grow faster than pre-pandemic projections. Loose fiscal policy in the United States exerts upward pressure on global interest rates and the dollar. It pushes up funding costs in the rest of the world, thereby exacerbating existing fragilities and risks.

While modest fiscal tightening is projected over the medium term, it will be insufficient to stabilise public debt in many countries.”

The IMF goes on to highlight the deterioration in fiscal position in the US and the need to rein in deficits.

It says: “In 2022, the US cyclically adjusted primary deficit was at 1.9% of GDP. In 2023, it multiplied (by) almost three, to reach 5.6% of GDP. And going forward, the primary deficit in the United States will stay in the range of three-point-something and only comes below three toward the end of our projection period. That leads to a situation where debt is increasing at about two percentage points of GDP per year.

We have emphasised many times that this fiscal policy puts pressure on policy rates. It puts pressure on long-term rates. It affects costs of funding everywhere in the world. And if the stance of policy in the United States is also uncertain, there is also an element of risk, which is reflected in the pricing.

Our view about the United States is that the authorities have a number of options that they can use to put the situation under control. And the way it will be done will be the outcome of the political process in the United States.”

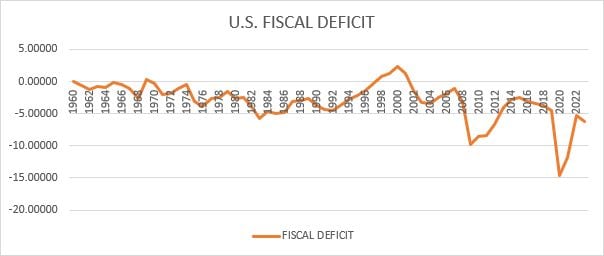

That this is a big issue for the stability of the dollar, the US and global economy and markets is well accepted. Even the Oracle of Omaha, Warren Buffett, at the annual Berkshire meeting made it a point to draw attention to this while calling Fed Chair, Jerome Powell a “very wise man”.

Buffett said: “(Powell) doesn’t control fiscal policy, and every now and then he sends out a disguised plea… because that’s (US deficit) where the trouble will be, if we have it,”

In fact, some argue that the Fed’s trimming of its quantitative tightening was a consequence of the US not reining in its deficits, that need to be funded.

WHAT RISING DEBT CAN SPELL

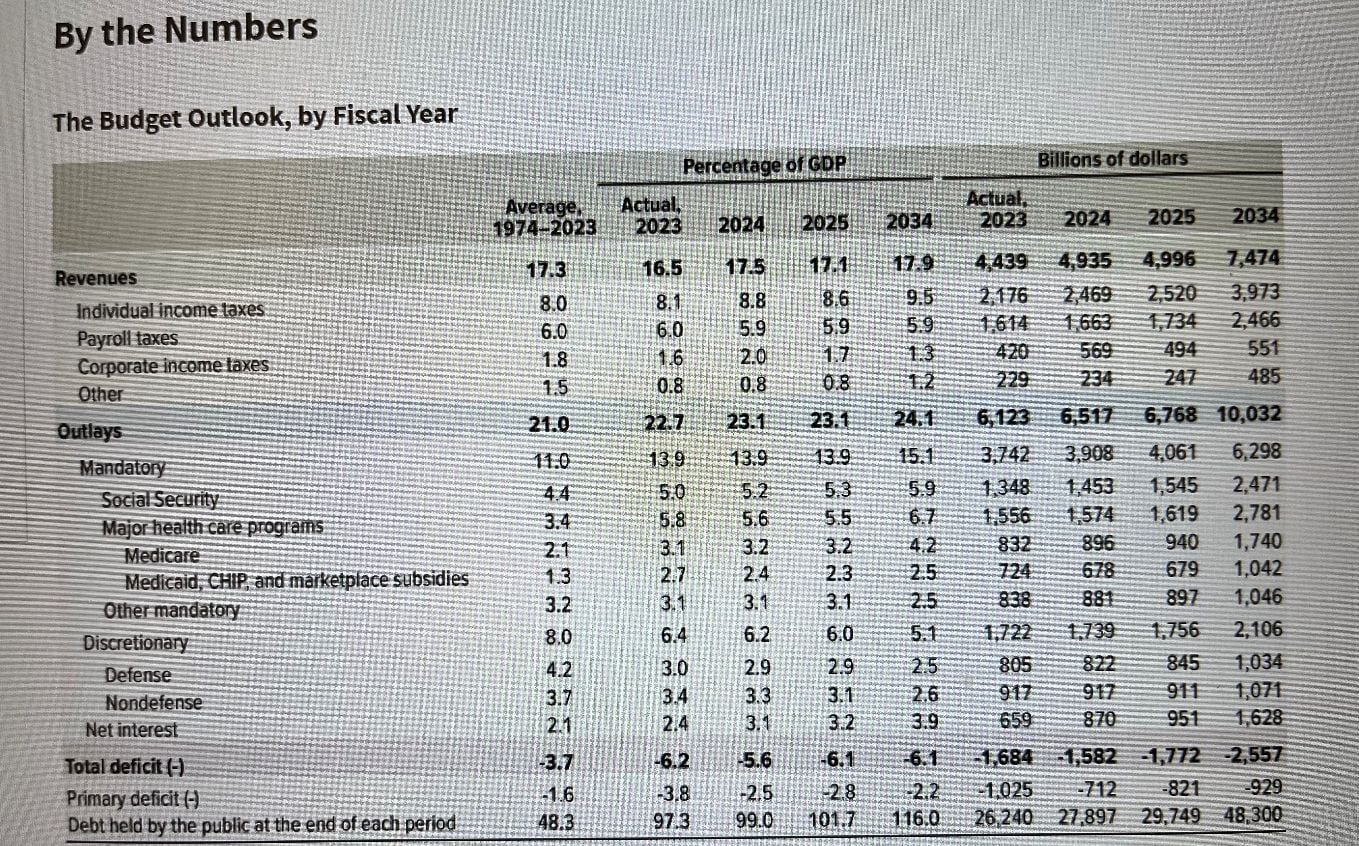

The rise in US debt has been truly unprecedented with net interest expenses expected to account for 17.6% of federal receipts in 2024.

What’s more, the US Congressional Budget Office (CBO) has projected it to remain at elevated levels.

In its outlook, the CBO says: “Measured in relation to gross domestic product (GDP), the deficit amounts to 5.6% in 2024, grows to 6.1% in 2025, and then shrinks to 5.2% in 2027 and 2028. After 2028, deficits climb as a percentage of GDP, returning to 6.1% in 2034. Since the Great Depression, deficits have exceeded that level only during and shortly after World War II, the 2007–2009 financial crisis, and the coronavirus pandemic”.

What this spells, is that the US government will need to print more dollars or borrow more from the future to bridge its deficit. That will exert pressure on cost of goods and services, pushing up inflation, and raise borrowing costs. This in-turn will put even more interest servicing pressure on the fisc.

All this will hurt the dollar, which could lose some value. This could spur some shift to safe-haven assets (more on this later), while rising yields on bonds could increase appetite for debt versus other asset classes.

All this can eventually hurt growth and employment, if corrective action is not taken soon.

So, not just the US economy and finances, but even the global markets could be significantly impacted.

CENTRAL BANKS’ RUSH FOR GOLD

In light of the growing dollar risks, the spate of gold buying by prominent central banks acquires added significance.

Already, some are proposing alternative exchange currencies to the greenback to settle trades between themselves.

While this is also an outcome of geopolitical developments, they hold significance for the dominance of the dollar and its value.

World Gold Council in its report for the first quarter of the year says: “With central banks accelerating their gold purchases to above 1,000t per year in 2022 and 2023, the market is finally beginning to appreciate the importance of their contribution to gold demand. Accounting for almost a quarter of annual gold demand in both those years, many have attributed central banks’ ongoing voracious appetite for gold as a key driver of its recent performance in the face of seemingly challenging conditions: namely, higher yields and US dollar strength.

And despite the high bar set in the last two years, the voracious buying has continued into 2024 in the face of the renewed gold price rally. Global official gold reserves rose by a net 290t, the highest Q1 total in our data series back to 2000; 1% higher than the previous Q1 record set in 2023 (286t) and 69% more than the five-year quarterly average (171t).

Not only is the long-standing trend in central bank gold buying firmly intact, it also continues to be dominated by banks from emerging markets. Ten central banks reported increased gold reserves (of a tonne or more) during Q1, all of whom have been active over recent quarters”.

Clearly, the central banks are onto something and building their gold buffers. And this includes our own Reserve Bank of India (RBI).

THE RISK OF A CRISIS

While the dollar may not be going to “nothing” anytime soon, US debt is clearly a trouble spot.

Billionaire investor Leon Cooperman recently told CNBC: “I think we’re heading into a financial crisis in this country (US)”.

And even while even that may be avoided, the risks of some impact on financial markets with the unprecedented growth in US debt levels is quite real and how US policymakers deal with the growing burden following the elections will be a key monitorable.

Valuations in the markets are the other key concern and risk factor for equities.

Warren Buffett speaking at the annual Berkshire Hathaway meeting clearly voted for treasuries and cash: “I don’t mind at all, given current conditions, building our cash position. When I look at the equity markets and the composition of what’s going on in the world, we find cash quite attractive.”

Given the heightened uncertainty, several moving parts (on direction of interest rates, economic policies with several nations going to polls, geopolitical developments and technological disruption with AI and such and the fairly well priced value of equities, this is a time for caution and bottom-up investing. So, stay alert, nimble and diversified.

Happy investing.

Click to read other ‘Bottomline’ articles

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter