Bajaj Auto aims to outpace industry growth with focus on higher-end segments

Summary

Executive Director Rakesh Sharma, said the strong sales in March and April were driven by the top half of the industry, which is growing at a slightly faster rate than the bottom half. And Bajaj continues to lead in the top half by a fair margin.

Bajaj Auto will maintain its lead in the domestic two-wheeler market, growing at least two to three times the industry average, particularly in the higher-end segments, according to Rakesh Sharma, the Executive Director of the company.

“The performance (in March and April together) is driven by the top half of the industry, which is growing at a slightly faster rate than the bottom half. And we are continuing to lead in the top half by a fair margin,” he said.

While sales typically slow down in May and June, Sharma says, “I think we will continue to outpace the industry, particularly in the top up by about two to three times. So I would say in the domestic business, we should again see a similar performance as in April in May.”

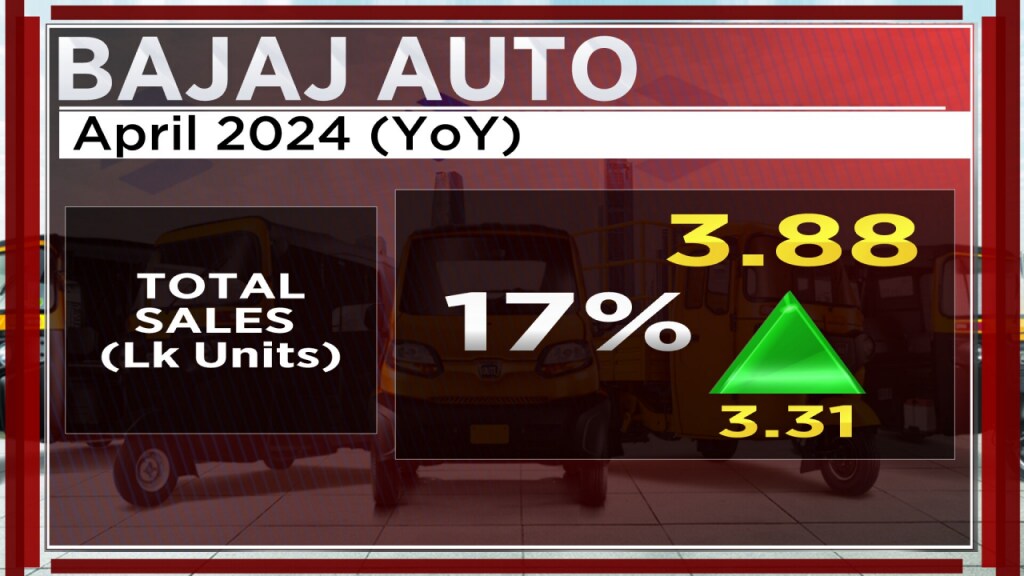

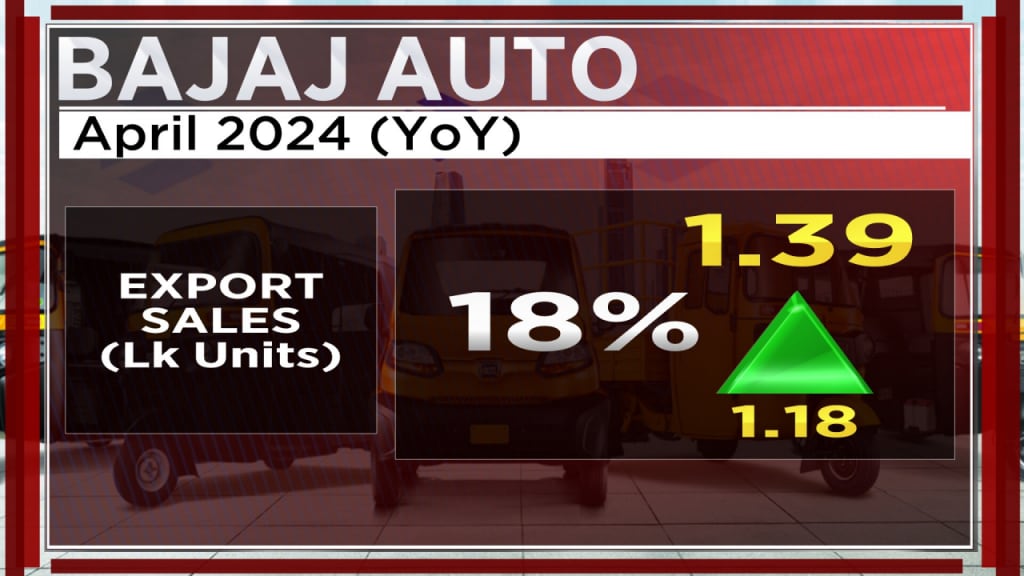

Bajaj Auto’s total sales in April grew 17% year-on-year (YoY) to 3.88 lakh units. Domestic sales were up 17% YoY at 2.49 lakh units, while exports grew 18% YoY at 1.39 lakh units.

The company wants to increase its market share in the higher-end market segment by introducing improved products and setting competitive prices.

“We are a tad below the leader, but I must point out that when we started the last financial year (FY24), we were 10 percentage points away from leadership in the top half. We are now 1% point away and of course; we will be thrust to ensure that we get to the number one spot in the top half,” added Sharma.

Also Read | Bajaj Auto strong Q4 show gets the company three target price hikes — Should you buy?

Bajaj Auto is all set to announce a new lineup of products starting tomorrow when it launches its biggest Pulsar.

Sharma expects the new launch to not only bring in volumes in the top segment but to boost the Pulsar brand in general.

Among export markets, Nigeria, which is significant for Bajaj with a large market share, is currently the only one that remains a concern.

“Nigeria is still struggling with finding an equilibrium on the currency side, which is having a dampening affecting on retail sales there,” Sharma noted.

Also Read | Bajaj Auto expects to grow faster than the industry as it nears entering Europe

On April 18, Bajaj Auto reported a 35% jump in its net profit over last year at ₹1,936 crore for the January-March period.

Also Read | Bajaj Auto Q4 results: Net profit jumps 35% to ₹1,936 crore; auto major declares dividend of ₹80 per share

Bajaj Auto’s market capitalisation is around ₹2,53,773.00 crore. Over the past year, its shares have risen by nearly 101%.

Automakers like Maruti Suzuki, Mahindra and Mahindra, Tata Motors, Bajaj Auto, and Hero Motocorp, along with others, share their sales numbers every month on the first day of the month.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter