Oil regulator PNGRB launches drive to increase piped gas adoption

Summary

The promotion of natural gas is part of the Prime Minister’s vision to increase its share in India’s energy basket to 15% by 2030, from the current 6.2% to transform the country into a gas-based economy.

Oil regulator PNGRB has launched a two-month-long nationwide drive to increase the adoption of piped natural gas as a cooking fuel in household kitchens in an attempt to cut dependence on imported fossil fuels.

“The Petroleum and Natural Gas Regulatory Board (PNGRB) along with city gas distribution entities will run a campaign from January 26 to March 31, aimed to promote the adoption of piped natural gas (PNG) among households and to expand PNG consumer base across a broader segment of the population,” it said in a statement.

While PNG has gained currency in the last few years after PNGRB expanded city gas networks to most parts of the country, sizable households continue to use either LPG or conventional fuels like firewood and cow dung for cooking.

While India is about 50% dependent on imports to meet cooking gas LPG needs, the use of conventional fuels is considered a health hazard.

PNG offers a viable alternative. It is convenient as it does not require ordering refills every time an LPG bottle is exhausted and is also cheaper.

Stating that natural gas is a clean and convenient fossil fuel, PNGRB said the campaign will be focussed on those areas where the gas pipeline network has been laid or will be laid in the immediate future.

The promotion of natural gas is part of the Prime Minister’s vision to increase its share in India’s energy basket to 15% by 2030, from the current 6.2% to transform the country into a gas-based economy.

“PNGRB is taking various initiatives to promote natural gas in households as cooking fuel as well as in transport, commercial, and industrial sectors,” the statement said.

“National PNG Drive is one amongst them to facilitate the supply of natural gas to existing registered customers besides enrolling customers for new PNG connections.” City Gas Distribution (CGD) entities will actively participate in the National PNG drive, and undertake various promotional activities to increase awareness of the use of PNG—a clean, environmentally friendly, safe, and reliable fuel.

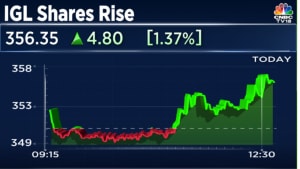

Indraprastha Gas Ltd (IGL) is partnering with PNGRB for the drive in the national capital. Other CGD entities are doing the same in other cities.

“During the campaign period, CGD entities will launch various promotional schemes. In addition, the entities will undertake door-to-door campaigns, organize road shows etc to encourage and enroll customers for conversion to PNG,” it said.

To date there are 300 geographical areas (GAs) authoriesd in the country, covering 98% of the population and 88% of its area for the development of CGD Network.

“The targets up to 2032 inter alia includes installation of 12.5 crore domestic PNG connections, establishment of 17,751 CNG stations,” the statement said.

As of November 30, 2023, 1.2 crore domestic PNG connections and 6,159 CNG stations have been established in the country.

“The National PNG Drive solicits collective efforts of all stakeholders, state governments, and local bodies to promote sustainable and clean energy solutions across the nation to meet the said objectives,” it added.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter