Bottomline | Equities: Many worries and a hope

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

There are several global reasons to be worried for equity investors, and one domestic hope.

The world today seems to be grappling with a whole host of problems, and amidst this, the recent run-up in equities was quite a surprise for many. Was it just a flash in the pan? That’s the bigger question investors will be focused on now. And most of the answers aren’t very encouraging. We delve into some of the key concerns and the India factor that offers a sliver of hope.

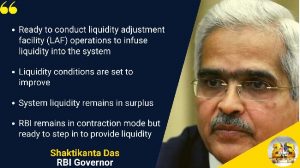

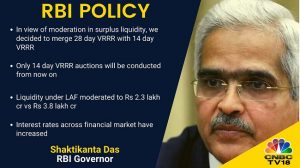

LIQUIDITY IS STILL TO TIGHTEN

The big elephant in the room is liquidity. Central banks haven’t significantly pulled the plug on this one yet, and once the contraction starts in earnest it could hurt not just equities, but all asset classes. As pointed out in an earlier piece, there is a strong correlation between the US Federal Reserve’s balance sheet and the S&P-500.

To give you a sense, the Federal Reserve assets are down just $114 billion from their peak, after adding $1.8 trillion since Covid struck. In the case of the ECB (Euro area), the reduction is even lesser at €85 billion of the near €3.2 billion added since the pandemic began. So, there is still a lot of liquidity sloshing around, evident also from the overnight reverse repo demand in the US with nearly $2.2 trillion being parked on average compared to almost nothing pre-Covid.

And while excess liquidity in the banking system doesn’t necessarily flow out of it, it tends to keep conditions easier for the economy and borrowers. Once the balance sheet reduction starts, it will compound the impact of rate hikes and lead to an exit from the easy money conditions that have prevailed for some time during the Covid years.

Also Read: Bottomline: Lessons for investors from India@75

Today, with the US housing sector already seeing a slowdown with rising mortgage rates, China having its own issues in the realty sector, and cryptos losing much of their sheen, portfolio money is bound to move to either equities, bonds or commodities. Even in commodities, the likely global slowdown could dampen interest. So, there may be few havens for such money in the near term, and this could keep some of it locked in equities.

But don’t forget, continued high inflation and further monetary tightening can change the equations.

US, EUROPE, AND CHINA ARE HURTING

Mortgage demand in the US is at its lowest since 2001 and new home sales declined by 12.6 percent in July compared to an estimate of a 2.6 percent decline. And with interest rates set to rise further, given Jerome Powell’s clear indication at the Jackson Hole economic symposium, the housing sector could see even more pain even as the monetary tightening starts to hurt other sections of the economy.

In Europe, the situation is more dire. At the root of the problem is the energy crisis triggered by the Russia-Ukraine war, and the consequent cut in energy supplies to the region by Russia. This and the worst drought in 500 years are hurting the economy badly. The day ahead rates for power in Germany, the worst affected, scaled to €600 / MWh compared to between €75-100 in 2020. Factories are shutting and many are closing their businesses as lack of supplies and inflation at near 10 percent are making them unviable. Most economists now see a high likelihood of a recession in Europe.

China may be on the other side of the curve on the rate cycle, it easing conditions not tightening, but it has its own cup of woes. A severe drought is set to hurt farm output even as it dents power generation, which is already impacting regions like Sichuan, manufacturing units have had to scale back or stop production. But the big problem for China is its housing sector. According to Jefferies’ Chris Wood, “The stark reality, for now, is that China is facing the biggest and most extended decline in construction activity since the property market was privatised in 1994.” He adds that this may require more decisive action than the recent rate cuts. “Sooner or later, the central government will have to take more decisive direct action to address the downturn in residential property, in terms of funding the completion of unfinished projects, given the sector’s huge importance… But, like Covid suppression, a full-scale policy response may have to await the outcome of the October /November meeting at which Xi is expected to be re-appointed,” Chris says in his GREED & Fear report.

Also Read: Bottomline: Your odds of beating the market are slim

Not surprising, therefore, that the consensus growth target for China has been revised down sharply to 3.7 percent from the 5.6 percent estimated in September 2021.

What’s concerning about the above is that three of the world’s biggest economic engines are slowing if not sputtering. And that can’t be good news for the markets (in an earlier article we had pointed to a strong correlation between US economic growth and the S&P-500) if the past is any reflection of the future.

INDIA IS A RELATIVE SAFE HAVEN

One stark difference between India and many of the larger economies is that its growth engine is chugging along relatively nicely. Growth will likely get impacted by global effects and the anticipated monetary tightening by the RBI, but it should still manage a respectable positive number. A clear divergence in India is its real estate sector—a significant engine for the economy—that seems to be just emerging from a decadal slowdown, unlike the housing markets in US and China.

Here, Chris Wood’s view is notable: “The main reason GREED & fear remains relatively relaxed about the impact of monetary tightening on growth is continuing evidence of an upturn in the residential property market. In this respect, India is the exact opposite of China with all the positive multiplier effects of a new up-cycle in the property after a seven-year downturn which lasted from 2013 to 2020.”

Also Read: Bottomline: A slowing US economy isn’t good for equities

The positive multiplier effect of the realty market, a fillip to manufacturing from the China +1 effect, and a still robust outlook for IT services (despite concerns on margin pressures) all augur well for the India story.

RESILIENCE WON’T BEAT THE TREND

While India remains in a relatively sweet spot and Indian equities could likely outperform, if global markets swing in one direction, Indian equities will mostly follow. That the Nifty closely tracks moves in US equities is a well-studied fact (also presented in an earlier column). So, the worries of the world may cloud local optimism in the near term, even as the effects of a proposed US Fed balance sheet tightening are still to kick in.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter