Rajasthan National Health Mission cancels agreement with Krsnaa Diagnostic

Summary

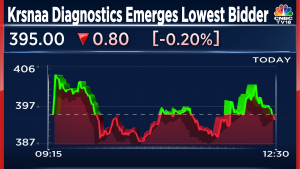

Shares of Krsnaa Diagnostics Ltd ended at Rs 537.50, up by Rs 9.25, or 1.69 percent on the BSE.

Krsnaa Diagnostics Ltd on Wednesday (July 19) said Rajasthan’s National Health Mission has cancelled the letter of acceptance for providing laboratory services in the state under the free diagnostics initiative on the hub and spoke model.

The company informed exchanges that there were requirements for the provision of submitting additional performance security. There were disagreements over providing this extra performance security due to certain technicalities.

“Whilst we have made various representations to the authorities on the same as well as communicated our willingness and commitment to execute the agreement. However, to our disappointment, the authorities decided to cancel the letter of acceptance,” it said.

Also, Krsnaa Diagnostics said the company, in collaboration with Telecommunications Consultants India Ltd (TCIL), has taken legal recourse and is actively pursuing this matter with utmost dedication and diligence. TCIL is a 100 percent Government of India undertaking and is the lead bidder for the National Health Mission project.

Further, the company pointed out that the cancellation of the letter of acceptance does not affect its existing business operations and the commitment to expand its business in both existing and recently executed agreements across various geographies remains steadfast.

In March this year, Krsnaa Diagnostics said it has bagged a tender worth Rs 450 crore by qualifying as the lowest bidder by the National Health Mission, Rajasthan. The company, in an official statement, mentioned that it will execute the project in three phases — 50 percent within 60 days and the remaining 50 percent in 90 days.

Shares of Krsnaa Diagnostics Ltd ended at Rs 537.50, up by Rs 9.25, or 1.69 percent on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter