European Central Bank keeps interest rate unchanged at 4.5%

Summary

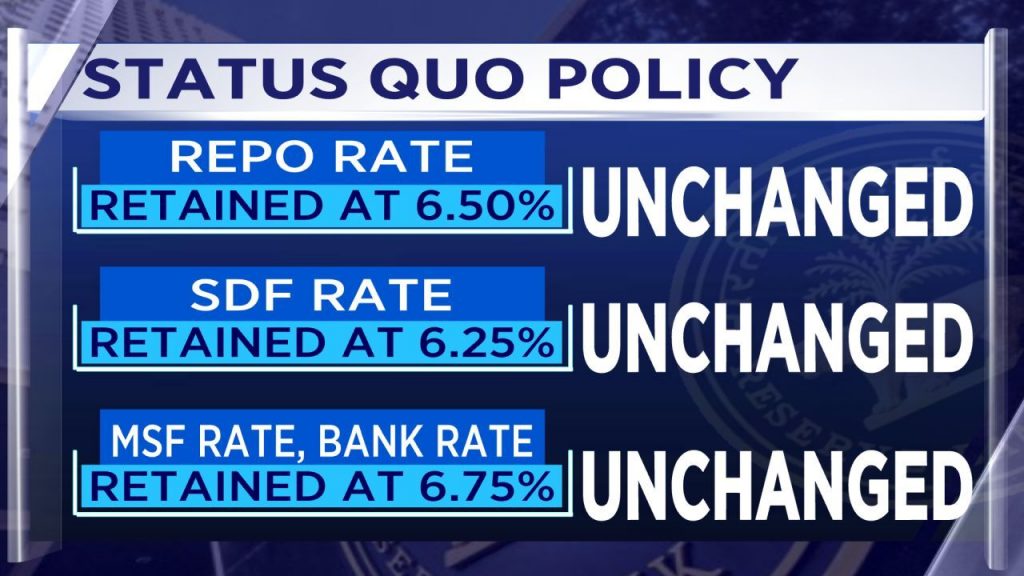

European Central Bank interest rate decision news: The ECB kept the interest rate unchanged at 4.5%, indicating a continuation of the current monetary policy stance. Similarly, the ECB has left the deposit facility rate steady at 4% and the marginal lending rate at 4.75%.

The European Central Bank (ECB) on Thursday, April 11, kept its benchmark interest rates unchanged for the fifth straight meeting, as was widely expected. With the ECB decision, the interest rate remains unchanged at 4.5%, indicating a continuation of the current monetary policy stance. Likewise, the ECB has left the deposit facility rate steady at 4% and the marginal lending rate at 4.75%.

#Breaking | European Central Bank (@ecb ) Keeps Interest Rate Unchanged At 4.5%

Here’s more 👇 pic.twitter.com/RqI21Eb7ML

— CNBC-TV18 (@CNBCTV18Live) April 11, 2024

However, the ECB signalled a potential future cut in the near future, particularly in its June meeting.

“…the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction,” it said in a statement.

That said, however, the decision may not be that easy amid persisting inflationary pressures in the US. The March figures, the third straight month of inflation readings well above the Federal Reserve’s 2% target, threaten to torpedo the prospect of multiple interest rate cuts this year. Fed officials have recently made clear that with the economy healthy, they’re in no rush to cut their benchmark rate despite their earlier projections that they would reduce rates three times this year.

The ECB and the developed world’s other central banks are tilting toward reducing interest rates that were imposed to tame inflation. The Swiss National Bank was the first major central bank to cut rates in the current cycle on March 21. The big exception is Japan, which raised rates for the first time in 17 years on March 19.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter

Andrade expects commodity prices to bounce back by next year and demand to improve. Old Bridge is gradually building its portfolio with commodities linked to infrastructure such as metals or soft commodities such as agriculture.

Andrade expects commodity prices to bounce back by next year and demand to improve. Old Bridge is gradually building its portfolio with commodities linked to infrastructure such as metals or soft commodities such as agriculture.