Indian Oil Corporation shares gain on signing MoU with Gujarat Gas to expand services

Summary

Indian Oil Share Price | Under the terms of the non-binding Memorandum of Understanding (MOU), both companies are poised to offer a comprehensive suite of products and services within Gujarat Gas Ltd’s authorised areas, GGL said in a filing to the stock exchanges on Monda

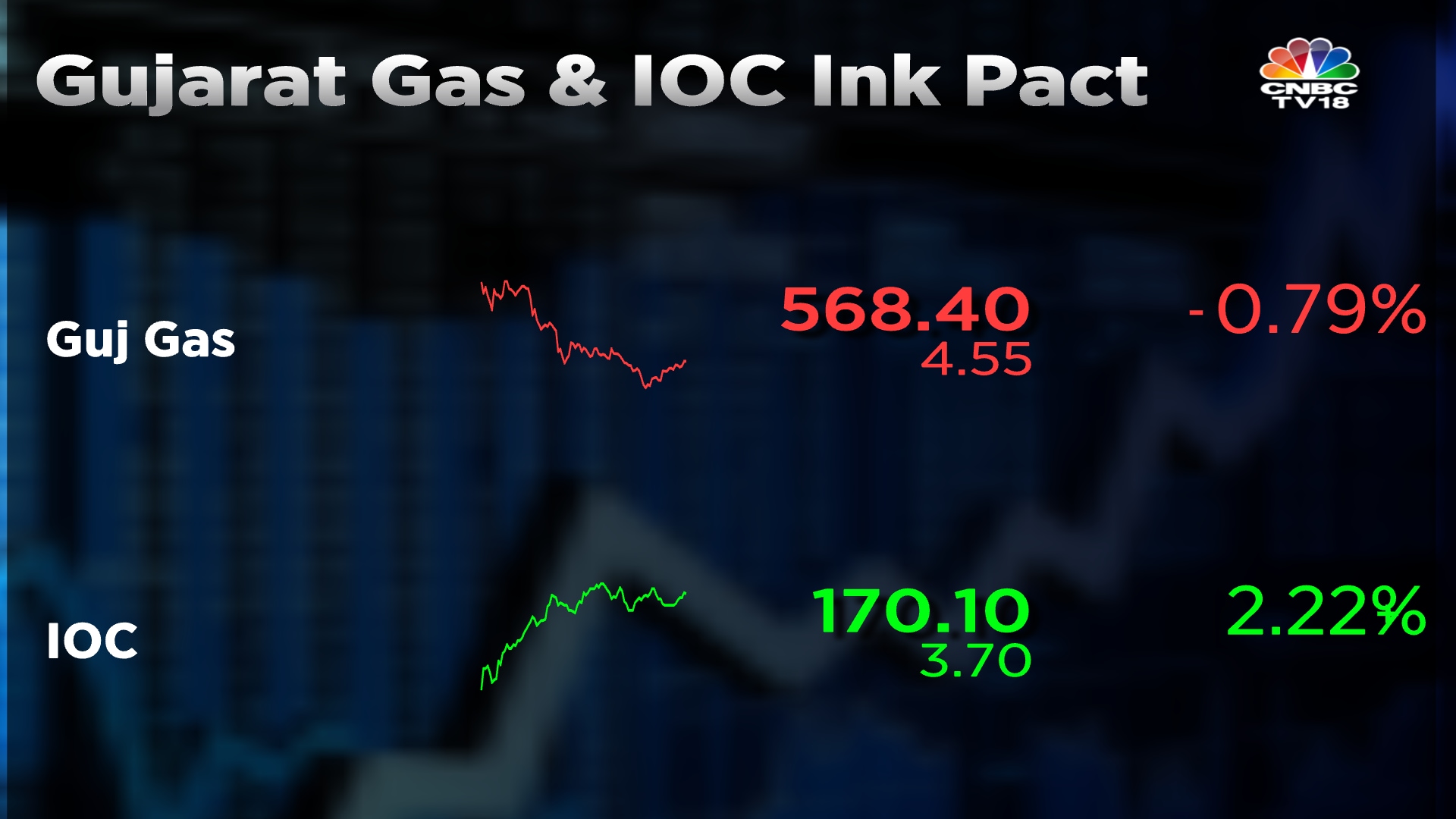

Indian Oil Corporation shares gained on Tuesday, April 16, after Gujarat Gas said it is signing an agreement with the former to expand its range of services and products for consumers.

Under the terms of the non-binding Memorandum of Understanding (MOU), both companies are poised to offer a comprehensive suite of products and services within Gujarat Gas Ltd’s authorised areas, GGL said in a filing to the stock exchanges on Monday.\

Indian Oil Corporation opened at ₹166.4 apiece in Tuesday’s trade session and was trading 2.28% higher at 10.55 am at ₹170.3 apiece on the BSE. Meanwhile, stock of Gujarat Gas Ltd (GGL) opened at ₹583 on the BSE on Tuesday, up 1.74% from its previous close of ₹573.15 apiece. However, Gujarat Gas gave up its opening gains and was trading 1.47% lower at ₹564.75 apuiece at 10.55 am.

As per the agreement, Indian Oil Corporation Ltd (IOCL) will extend its offerings by providing liquid fuels through Gujarat Gas outlets.

IOCL will also make its extensive range of automotive lubricants, greases, and specialties available at the GGL outlets, catering to the diverse needs of customers.

As part of the alliance, IOCL will establish CNG facilities at its company owned, company operated (COCO) outlets, boosting the accessibility of this eco-friendly fuel option.

In a reciprocal move, GGL will set up CNG Mother Facilities at IOCL outlets, further enhancing the availability and distribution of compressed natural gas. This partnership between GGL and IOCL signifies a significant step forward in the quest for sustainable and accessible energy solutions in the country, it said.

By leveraging their resources, both players are set to cater to the needs of consumers while contributing to the nation’s energy security and environmental goals.

Also Read: Marksans Pharma has rallied over 100% in 12 months and a major investor just bought stake

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter