Decoding the recent surge in gold prices: Here are key ways to invest in yellow metal now

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

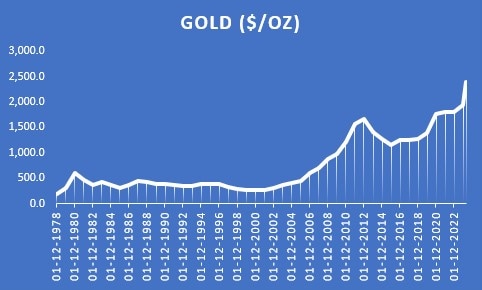

While gold prices may experience short-term fluctuations, the overall trend remains positive, driven by geopolitical tensions, central bank buying, and interest rate expectations. Here’s more

Gold prices witnessed a slight decline on Monday (April 15). On the Multi Commodity Exchange (MCX), gold contracts for June delivery traded lower ₹80 or 0.23% at ₹71,763 per 10 grams in a business turnover of 22,483 lots. This dip, attributed to profit booking and weak global cues, reflects a momentary shift in market sentiment.

However, analysts emphasise that despite this minor setback, the overall trend for gold remains bullish, with prices reaching new heights in recent times.

Understanding market dynamics

Geopolitical tensions

The ongoing conflict between Iran and Israel continues to fuel uncertainty in the global market.

This geopolitical turmoil has been a significant driver of gold prices, as investors seek refuge in the precious metal amid heightened risk perceptions.

Central bank buying

Central banks around the world have been actively increasing their gold reserves, contributing to the upward trajectory of gold prices.

This steady demand from institutional buyers has provided a strong foundation for the metal’s value.

Interest rate expectations

Speculation regarding potential interest rate cuts by the Federal Reserve later in the year has further supported gold’s appeal.

Lower interest rates reduce the opportunity cost of holding gold, making it an attractive investment option in times of economic uncertainty.

What comes next?

Rahul Kalantri, VP of Commodities at Mehta Equities Ltd, maintains a positive outlook for gold, citing ongoing support from global central banks and persistent geopolitical risks.

However, Colin Shah, MD of Kama Jewelry, believes that the price of gold will continue to be volatile and highly unpredictable, given the escalations between the countries in conflict and the response by G7.

Investment strategies

Investors seeking to capitalise on the current market conditions may consider various strategies for gold investment, including:

Physical gold

Investing in physical gold, such as bars or coins, provides investors with a tangible asset that can serve as a hedge against economic uncertainty and inflation.

Gold Exchange Traded Funds (ETFs)

Gold ETFs allow individuals to invest in gold in a dematerialised format, which can be bought and sold on the stock exchange like shares.

Gold equivalent to physical quantity is deposited in an electronic form, in the purchaser’s demat account.

These are listed on the stock exchange, where one can get real-time updates about their price. ETFs don’t have any exit loads, which means investors can buy or sell the units at any time during the market hours.

Sovereign Gold Bonds (SGBs)

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash, and the bonds are redeemed in cash on maturity.

It is considered a safe way to invest in gold, especially for those with a long investment window of 5-8 years.

The Reserve Bank of India (RBI) issues SGBs multiple times a year and fixes a price for each issuance. Users can also buy or sell SGBs in the secondary market.

Gold mutual funds

Gold mutual funds are open-ended funds that allow the citizens to invest without a Demat account. The gold fund units are determined by way of Net Asset Value (NAV), which is disclosed at the end of the trading hours. In this scheme, experts manage the investment professionally to create wealth and reduce risks.

Units of gold funds can be redeemed by selling them back to the fund house based on the NAV for the day.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter