Escorts Kubota aims for 25% export growth as supply chain hassles start easing

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Escorts Kubota’s strong focus on innovation and customer-centric solutions is expected to drive its growth in the global market. Despite facing challenges such as supply chain issues and unseasonal rains, the company remains confident about achieving its export growth targets for the fiscal year 2024. With a strong commitment to sustainability and growth, Escorts Kubota is well-positioned to maintain its leadership position in the industry and contribute to the growth of the Indian economy.

Escorts Kubota, a tractor and construction equipment manufacturer, is looking at a significant growth in exports for the fiscal year 2024.

According to Bharat Madan, the Group CFO of Escorts Kubota, the company is expecting a growth rate of 25 percent for exports in FY24 as compared to FY23.

Madan explained that the weaker export performance in April was due to some supply chain issues that the company faced. Despite this setback, Escorts Kubota remains optimistic about the future and is working towards resolving these issues to achieve their export growth targets.

Madan also noted that the festive season in March impacted the company’s sales in April. He stated that April was slower due to the festive season in March and the company anticipates a flat first quarter.

“April was slow because the festive season this time fell in March,” he said.

Also Read | Escorts Kubota misses estimates, profit dips 8%; final dividend at Rs 7/share

Additionally, unseasonal rains have also had an impact on the company’s performance in the current quarter.

“Going forward, the way things are – there will be some impact of the unseasonal rains which has happened in the last two months. So in certain pockets we are seeing that impacting the harvest. But going forward, the expectation is that this quarter can be a flat quarter,” he explained.

However, Madan does not expect significant demand impact on agriculture due to El Nino.

“We don’t see a major impact on the agriculture,” he mentioned.

Also Read | March Auto Sales: Escorts Kubota tractor sales rise 2.3%

Escorts Kubota remains focused on expanding its presence in the global market and is actively working towards increasing its market share. The company is confident about achieving its export growth targets for the fiscal year 2024 and is committed to driving growth through innovation and customer-centric solutions.

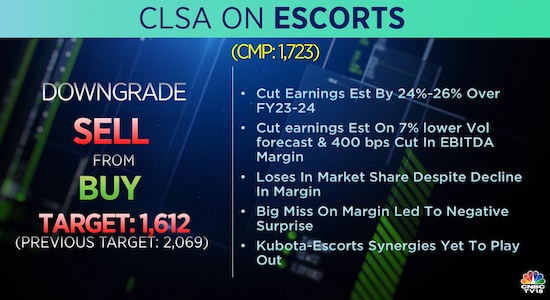

The company, on Wednesday, reported an 8.2 percent year-on-year (YoY) decline in consolidated net profit at Rs 185.5 crore for the fourth quarter that ended March 31, 2023.

Also Read | Here is why BofA Securities is negative on India’s two leading tractor manufacturers

In the corresponding quarter last year, the company posted a net profit of Rs 202 crore. CNBC-TV18 Polls had predicted a profit of Rs 178 crore for the quarter under review.

In the March quarter, consolidated revenue stood at Rs 2,183 crore during the period under review, up 16.8 percent against Rs 1,869 crore in the corresponding period of the preceding fiscal. CNBC-TV18 Polls had predicted revenue of Rs 2,198 crore for the quarter under review.

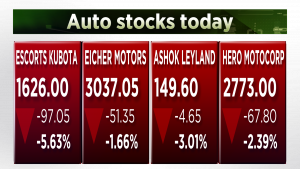

The stock has remained flat for the past week and has gained more than 7 percent over the last month.

For more details, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter