Here are key stocks that moved the most on May 12

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The Sensex ended 471 points lower at 48,691 while the Nifty fell 154 points to settle at 14,696.

Indian indices ended lower for the second session on Wednesday dragged by metals and financials. Meanwhile, losses in Asian peers and domestic COVID-19 deaths crossing a quarter-million mark also weighed on the sentiment.

The Sensex ended 471 points lower at 48,691 while the Nifty fell 154 points to settle at 14,696.

Broader markets were also lower for the day with the midcap and smallcap indices down 0.8 percent and 0.5 percent, respectively.

On the Nifty50 index, Tata Motors, Titan, Maruti, Powergrid and Cipla were the top gainers while Tata Steel, JSW Steel, IndusInd Bank, BPCL and Hindalco led the losses.

Here are the key stocks that moved today:

Godrej Consumer Products: Godrej Consumer Products (GCPL) shares surged over 21 percent after the consumer major reported a sharp 59 percent jump in March quarter net profit. The FMCG major posted a consolidated net profit of Rs 365.84 crore for the fourth quarter of fiscal 2021, registering a 59.13 percent growth over Rs 229.90 crore in the year-ago quarter. The company’s consolidated revenue from operation during Q4FY21 rose 26.8 percent to Rs 2,730.74 crore from Rs 2,153.80 crore in the year-ago period.

Siemens: Siemens share price added 3 percent after the company posted a 90 percent rise in its net profit for the March quarter. The consolidated net profit of the company stood at Rs 334.4 crore in the quarter under review as against Rs 175.7 crore in the year-ago quarter on the back of higher revenue. Total income rose to Rs 3,540 crore in the March quarter from Rs 2,722.1 crore in the same period a year ago. Meanwhile, the revenue from continuing operations came in at Rs 3,298 crore, up 29.6 percent YoY. The company follows the October to September financial year.

Venkys: Shares of Venky’s (India) were locked in a 20 percent upper circuit of Rs 2,143.20 per share on the BSE after the company reported a standalone net profit of Rs 77.90 crore for the quarter ended March 2021 (Q4FY21). It had posted a net loss of Rs 96.73 crore in the year-ago quarter. On a sequential basis, the net profit was down 27 percent from Rs 106.50 crore as the company witnessed some negative impact due to the outbreak of bird flu. The company’s revenue from operations grew 42 percent to Rs 941.35 crore from Rs 660.86 crore in the corresponding quarter of the previous fiscal.

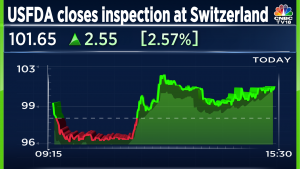

Dishman Carbogen Amcis: Shares of Dishman Carbogen Amcis fell 13.5 percent after the firm reported a loss of Rs 135.02 crore for the March quarter. The firm posted a profit of Rs 50.19 crore in the previous quarter year ago. Sales for the firm, however, rose 3.36 percent to Rs 529.32 crore in the quarter ended March 2021 as against Rs 512.11 crore during the previous quarter ended March 2020. For the full year, the firm reported a net loss of Rs 165.13 crore in FY21 versus a net profit of Rs 158.51 crore in FY20. Sales also declined 6.44 percent to Rs 1912.03 crore in the year under review as against Rs 2043.60 crore during the previous year ended March 2020.

Vodafone Idea: Vodafone Idea share price jumped 8.5 percent after the telco added subscribers in February for the first time since October 2019. Vodafone Idea added 6.5 lakh users and expanded its user base to 282.6 million in February, as per the latest data released by the Telecom Regulatory Authority of India (TRAI). Vodafone Idea’s market share in total wireless subscribers stood at 24.20 percent.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter