Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Washington and Beijing have been increasingly at loggerheads over how American companies operate in China, Chinese exports and manufacturing capacity, and strains are also growing over Beijing’s support for Russia in its war in Ukraine, as per Reuters.

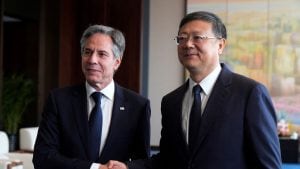

US Secretary of State Antony Blinken on Thursday called on China to provide a level playing field for American businesses as he began a visit aimed at resolving a raft of contentious issues that could jeopardise the newly repaired relationship.

Blinken‘s trip is the latest high-level contact between the two nations that, along with working groups on issues from global trade to military communication, have tempered the public acrimony that drove relations to historic lows early last year.

But Washington and Beijing have been increasingly at odds over how American companies operate in China, Chinese exports and manufacturing capacity, and strains are also growing over Beijing’s backing of Russia in its war in Ukraine.

State Department spokesperson Matthew Miller said that at a meeting with China’s top official in Shanghai, Chen Jining, Blinken raised concerns about China’s “trade policies and non-market economic practices.”

Blinken also “stressed that the United States seeks a healthy economic competition with the PRC and a level playing field for US workers and firms operating in China.”

The PRC, or People’s Republic of China, is the country’s official name.

Responding to the comments later in the day, the spokesperson for the Ministry of Foreign Affairs, Wang Wenbin, told a regular media conference that “China has always been carrying out economic and trade cooperation in accordance with the principles of the market.”

“We hope that the US side will respect the principle of fair competition, abide by WTO rules and work with China to create favourable conditions for the sound and steady development of China-US economic and trade relations,” said Wang.

While in Shanghai, Blinken also spoke with business leaders, as well as American and Chinese students at New York University’s local campus, where he said intercultural interactions were “the best way to make sure that we start by hopefully understanding one another”.

Support for Russia

Blinken will head to Beijing on Friday for talks with his counterpart, Foreign Minister Wang Yi, and possibly President Xi Jinping. Those meetings could be fraught.

Just as Blinken landed in Shanghai, President Joe Biden signed a rare bipartisan bill that included $8 billion to counter China’s military might, as well as billions in defence aid for Taiwan and $61 billion in aid to Ukraine.

Biden also signed a separate bill tied to the aid legislation that bans TikTok in the US if its owner, the Chinese tech firm ByteDance, fails to divest the popular short video app over the next nine months to a year.

Blinken will press China to stop its firms from retooling and resupplying Russia’s defence industrial base. Moscow invaded Ukraine days after agreeing a “no limits” partnership with Beijing, and while China has steered clear of providing arms, US officials warn Chinese companies are sending dual-use technology that helps Russia’s war effort.

Without providing details, a senior State Department official told reporters that Washington was prepared to “take steps” against Chinese firms it believes are damaging US and European security.

State-run China Daily said in an editorial that there was “a huge question mark over what the discussions between Blinken and his hosts can yield” and that both sides “have been largely talking past each other.””On the conflict in Ukraine, the world can see it clearly that the Ukraine issue is not an issue between China and the US, and the US side should not turn it into one,” it said.

Other state media also highlighted the tensions over the differences. “Plenty of animosity remains, primarily fuelled by Washington’s adherence to a zero-sum mindset and framing China as a threat,” a commentary in state-run Xinhua news agency said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

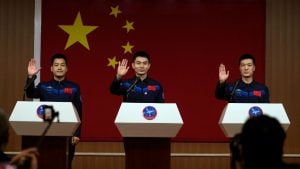

The three crew members for the manned space mission by China are slated for lift-off at 1259 GMT (6.29 pm IST) on Thursday, April 25, from the Jiuquan Satellite Launch Center situated on the edge of the Gobi Desert.

The China Manned Space Agency (CMSA) will send three astronauts to the country’s space station on the Shenzou-18 crewed spaceship on Thursday (April 25).

For China‘s 13th crewed mission, the three-member crew of Ye Guangfu, Li Cong and Li Guangsu will stay in orbit for about six months and return to Earth in October. The crew will conduct more than 90 experiments during this period.

These are some of the tasks for the astronauts, according to Lin Xiqiang, Deputy Director of CMSA:

China will carry out its first in-orbit aquatic ecological research programme will during this mission.

Lin Xiqiang, Deputy Director of the CMSA, suggested that China has been working to provide access to its space station to foreign astronauts and space tourists

“We will accelerate the research and promotion of the participation of foreign astronauts and space tourists in flights with China’s space station,” he said, as reported by AP. “We definitely expect to see astronauts of different identities on China’s space station.”

The three crew members are slated for lift-off at 1259 GMT (6.29 pm IST) on Thursday from the Jiuquan Satellite Launch Center situated on the edge of the Gobi Desert.

With its first manned space mission in 2003, China became the third nation after erstwhile Soviet Union and US to conduct a manned space mission with its own resources.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Officials this week told some of the biggest brokerages to suspend any increase in their net exposure to over-the-counter derivatives involving domestic A shares, including snowball products which are based on options contracts, said the people.

China is moving to curb ‘snowball’ derivatives after brokers hiked returns to near-record levels to attract investors to the risky products following a stock-market selloff, according to people familiar with the matter.

Officials this week told some of the biggest brokerages to suspend any increase in their net exposure to over-the-counter derivatives involving domestic A shares, including snowball products which are based on options contracts, said the people. While the restrictions are temporary, the regulators didn’t indicate when they may be lifted or eased, the people said, asking not to be identified as the communications are private.

The crackdown adds to a range of restrictions imposed on other derivatives businesses since late last year as Beijing pledged to stabilise its stock market amid an uncertain economic outlook and waning investor confidence. Bloomberg News reported on Monday that some brokerages were using coupon rates of more than 40% to attract investors back into the snowball market.

The move also comes as the ruling party’s disciplinary watchdog starts a new round of inspections at financial regulators and other state entities.

The China Securities Regulatory Commission didn’t immediately respond to a faxed request for comment.

Snowballs are exotic options that pay bond-like coupons as long as the stock index they reference stays within a predetermined range. The longer the investors hold the product, the bigger the return — like a rolling snowball. Similar offerings cost Natixis SA almost $300 million in 2018.

An estimated 330 billion yuan ($46 billion) of snowballs were outstanding as of November, according to UBS Securities Co.

Brokerages launched the price war to win back investors after the market rout earlier this year, when most snowballs fell through levels that threatened to wipe out coupons or even impose losses. The so-called ‘knock-ins’ prompted brokerages to sharply increase purchases of stock-index futures and later sell them to limit risks. That exacerbated the stock-market slump by widening the discount with underlying indices and forcing quantitative hedge funds to unwind positions.

As the market stabilised gradually, two snowball products issued last month offered coupon rates of more than 40%, a level unseen since at least 2022, according to data compiled by Galaxy Technologies, which didn’t identify the issuers. The intensifying price competition is adding to pressures on profitability as securities firms seek to revive sales to help offset mounting hedging losses.

While regulators have already curbed some other derivatives businesses like the so-called Direct Market Access products favored by quant funds, they had until now refrained from imposing fresh restrictions on snowballs, the people said. In 2021, authorities asked brokerages to gauge risks tied to the products and ensure they are only sold to qualified investors, Bloomberg reported at the time.

China’s OTC derivatives market has been a battleground that top brokerages from Citic Securities Co. to China International Capital Corp. ‘must fight for’ in recent years, contributing stable profits, according to an Industrial Securities Co. report in January.

The options business, which includes products such as snowballs that are often tied to A-share indices, is a main pillar for the OTC market. Its outstanding value has surged more than 10 times since 2015 to 1.4 trillion yuan as of July 31.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

“The largest stocks in the China index have been generally fine on earnings/fundamentals. So China underperformance is purely due to valuation collapse,” strategists including Sunil Tirumalai wrote in a note on Tuesday.

UBS Group AG lifted China and Hong Kong stocks to overweight, citing resilient earnings despite the nation’s property and macro worries.

“The largest stocks in the China index have been generally fine on earnings/fundamentals. So China underperformance is purely due to valuation collapse,” strategists including Sunil Tirumalai wrote in a note on Tuesday.

The broker is funding the China upgrade by downgrading Taiwan and South Korea to neutral, the strategists said, as tech optimism is getting priced in given the sector’s “decade-high premiums to rest of the universe.”

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

China and India have typically vied over the title of world’s biggest buyer. But that shifted last year as Chinese consumption of jewelry, bars and coins swelled to record levels. China’s gold jewelry demand rose 10% while India’s fell 6%. Chinese bar and coin investments, meanwhile, surged 28%.

Gold’s rise to all-time highs above $2,400 an ounce this year has captivated global markets. China, the world’s biggest producer and consumer of the precious metal, is front and center of the extraordinary ascent.

Worsening geopolitical tensions, including war in the Middle East and Ukraine, and the prospect of lower US interest rates all burnish gold’s billing as an investment. But juicing the rally is unrelenting Chinese demand, as retail shoppers, fund investors, futures traders and even the central bank look to bullion as a store of value in uncertain times.

Biggest Buyer

China and India have typically vied over the title of world’s biggest buyer. But that shifted last year as Chinese consumption of jewelry, bars and coins swelled to record levels. China’s gold jewelry demand rose 10% while India’s fell 6%. Chinese bar and coin investments, meanwhile, surged 28%.

And there’s still room for demand to grow, said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. Amid limited investment options in China, the protracted crisis in its property sector, volatile stock markets and a weakening yuan are all driving money to assets that are perceived to be safer.

“The weight of money available under these circumstances for an asset like gold – and actually for new buyers to come in – is pretty considerable,” he said. “There isn’t much alternative in China. With exchange controls and capital controls, you can’t just look at other markets to put your money into.”

Imports Jump

Although China mines more gold than any other country, it still needs to import a lot and the quantities are getting larger. In the last two years, overseas purchases totaled over 2,800 tons — more than all of the metal that backs exchange-traded funds around the world, or about a third of the stockpiles held by the US Federal Reserve.

Even so, the pace of shipments has accelerated lately. Imports surged in the run-up to China’s Lunar New Year, a peak season for gifts, and over the first three months of the year are 34% higher than they were in 2023.

Central Bank

The People’s Bank of China has been on a buying spree for 17 straight months, its longest-ever run of purchases, as it looks to diversify its reserves away from the dollar and hedge against currency depreciation.

It’s the keenest buyer among a number central banks that are favoring gold. The official sector snapped up near-record levels of the precious metal last year and is expected to keep purchases elevated in 2024.

Shanghai Premium

It’s indicative of gold’s allure that Chinese demand remains so buoyant, despite record prices and a weaker yuan that robs buyers of purchasing power.

As a major importer, gold buyers in China often have to pay a premium over international prices. That jumped to $89 an ounce at the start of the month. The average over the past year is $35 versus a historical average of just $7.

For sure, sky-high prices are likely to temper some enthusiasm for bullion, but the market’s proving to be unusually resilient. Chinese consumers have typically snapped up gold when prices drop, which has helped establish a floor for the market during times of weakness. Not so this time, as China’s appetite is helping to prop up prices at much higher levels.

That suggests the rally is sustainable and gold buyers everywhere should be comforted by China’s booming demand, said Nikos Kavalis, managing director at consultancy Metals Focus Ltd.

China’s authorities, which can be quite hostile to market speculation, are less sanguine. State media have warned investors to be cautious in chasing the rally, while both the Shanghai Gold Exchange and Shanghai Futures Exchange have raised margin requirements on some contracts to snuff out excessive risk-taking. SHFE’s move followed a surge in daily trading volumes to a five-year high.

ETF Flows

A less frenetic way to invest in gold is via exchange-traded funds. Money has flowed into gold ETFs in mainland China during almost every month since June, according to Bloomberg Intelligence. That compares with chunky outflows in gold funds in the rest of the world.

The influx of money has totaled $1.3 billion so far this year, compared with $4 billion in outflows from funds overseas. Restrictions on investing in China are again a factor here, given the fewer options for Chinese beyond domestic property and stocks.

Chinese demand could continue to rise as investors look to diversify their holdings with commodities, BI analyst Rebecca Sin said in a note.

On the Wire

Chile imposed temporary anti-dumping tariffs on Chinese steel products used in the country’s mining industry in a bid to support faltering local producers. The move pushed Cap SA to reverse a decision to wind down its steel mills.

China’s most-promising industries are facing a growing threat of trade restrictions from Western governments, blurring the outlook for stocks that have the potential to fuel the nation’s market growth.

With Beijing already becoming a top target in the US election campaign, President Xi Jinping’s government is resisting any move that could backfire on the world’s second-largest economy.

When you introduce a raft of tariffs and restrictions to protect domestic industries, you’d better make sure there are some around to protect. That’s a major problem with the US decision to treat China’s clean technology leadership as grounds for a trade fight.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

News agency AFP quoted a senior researcher at Stockholm International Peace Research Institute (SIPRI), Nan Tian as saying that for the first since since 2009, military spending rose across all five geographical regions.

Global military expenditure in 2023 witnessed its steepest increase in more than a decade, touching an all-time high of $2.4 trillion, as per a new report by the Stockholm International Peace Research Institute (SIPRI), news agency AFP reported.

This was fuelled by the wars and rising global tensions. The report stated that military spending in Europe, Asia and Middle East witnessed a particularly large increase.

AFP quoted a senior researcher at SIPRI, Nan Tian as saying that for the first since since 2009, military spending rose across all five geographical regions.

The report stated that military spending increased by 6.8% in 2023, its steepest year-on-year increase since 2009, AFP reported.

Tian told the news agency that the increased military spending was a reflection of the deteriorating peace and security across the world.

The top five spenders were the United States, China, Russia, India and Saudi Arabia, AFP reported citing the report.

Tian said the continuation of the Ukraine war led to a rise in military spending in Russia and Ukraine and many of the European countries. As per SIPRI’s estimates, Russia’s spending increased by 24% in 2023, reaching $109 billion.

Ever since Russia annexed Ukraine’s Crimea in 2014, its military spending has increased by 57%.

On the other hand, Ukraine’s military spending increased by 51% to $64.8 billion. However, it also got military aid of $35 billion, majority of which came from the US. As per this, the combined spending and aid equalled over nine tenths of the spendings of Russia.

Tian told AFP that even though Russia and Ukraine’s overall budgets were more or less close in 2023, Kyiv’s military spending was 37% of its GDP and 50% of the entire government spending. On the other hand, Russia’s military spending equalled to 5.9% of its GDP. Tian added that Ukraine does not have as much room to increase its spending.

In Europe, Poland witnessed its largest increase in spending so far, increasing 75% to $31.6 billion, as per the report.

Military spending also increased across the Middle East, where Israel, which the second-largest spender in the region, witnesseda 24% increase in its expenditure to $27.5 billion last year. This was primarily driven by its offensive in Gaza.

Meanwhile, the Middle East’s largest spender Saudi Arabia, also increased its spending by 4.3% to around $75.8 billion, the report stated.

The US, which spends the most on its military compared to other nations, increased its expenditure by 2.3% to $916 billion, as per the report. China’s military spending expanded for the 29th consecutive year by another 6% to around $296 billion.

Japan and Taiwan both upped their military expenditures by 11% each to %50.2 billion and $16.6 billion, respectively, in 2023.

India, which is the fourth largest spender in the world, increased its spending to $83.6 billion in 2023, a 4.3% rise in expenditure.

Increase in spending in the Caribbean and Central America were driven by struggles such as fighting organised crime. The Domincian Republic increased its expenditure by 14%, responding to the worsening gang violence in Haiti spilling over the border.

Africa also witnessed an increase in its military budgets. The Democratic Republic of Congo’s spending more than doubled by 105% to $794 million, the largest increase by any nation percentage-wise, as tensions increased in neighbouring Rwanda.

South Sudan witnessed the second-largest increase of 78% to $1.1 billion.

Tian told AFP that the expectation is that the increasing military expenditure trend is likely to continue for a few years.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The one-year loan prime rate was held at 3.45%, in line with almost all of the forecasts from economists surveyed by Bloomberg News. The five-year rate, a reference for mortgages, was kept at 3.95% as expected, according to data from the People’s Bank of China.

Banks in China maintained their benchmark lending rates on Monday, following the Chinese central bank’s recent decision to stand pat on monetary policy.

The one-year loan prime rate was held at 3.45%, in line with almost all of the forecasts from economists surveyed by Bloomberg News. The five-year rate, a reference for mortgages, was kept at 3.95% as expected, according to data from the People’s Bank of China.

China faces the challenge of stimulating the economy while keeping its currency stable as sticky inflation in the US pushes back rate-cut bets. Looser monetary policy can help boost growth but also exacerbate currency weakness and capital flight.

China withdrew cash from the banking system for a second consecutive month last week, signaling its caution toward monetary easing. The yuan is facing renewed depreciation pressure after a fresh round of hot US inflation bolstered the dollar and Treasury yields.

The loan rates are based on the interest rates that 20 banks offer their best customers, and are published by the PBOC monthly. They are quoted as a spread over the central bank’s one-year policy rate, or the medium-term lending facility.

China is struggling to revive borrowing demand as the property market keeps slumping and consumer confidence remains anemic. Credit growth continued to slow in March and banks extended less loans than expected.

While China reported strong growth in the first quarter, the latest data show the bounce slowed in March, with the rise in retail sales and industrial output falling short of forecasts. Economists say more stimulus will be needed to reach the ambitious annual growth target of around 5%.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

In a statement, the Chinese commerce ministry said that it will support overseas institutions to issue yuan bonds in the country, and also encourage tech companies, including foreign-invested ones, to raise money via bond issuance, as per Reuters.

China published measures on Friday aimed at promoting overseas investment in its technology sector, in a latest bid to attract foreign investors amid signs some are considering shifting away from the world’s second-largest economy.

China will support overseas institutions to issue yuan bonds in the country, and also encourage tech companies, including foreign-invested ones, to raise money via bond issuance, the commerce ministry said in a statement.

The government will also facilitate foreign investment in Chinese tech firms via an inbound investment scheme, QFLP, and will “efficiently” approve applications for licences under QFII and RQFII – programmes that allow foreign investment in Chinese stocks and bonds.

The ministry added that China would relax restrictions on foreign strategic investments in Chinese listed firms.

The measures come as China strives to shore up confidence among overseas investors amid a slowing economy and geopolitical tensions.

Chinese President Xi Jinping has also called for an unleashing of “new productive forces”, underscoring the urgency for “quality” growth through technological breakthroughs and innovation.

The measures were jointly published by 10 government agencies that also include the central bank and China’s securities and forex regulators.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously